As retailers decide whether cannabidiol (CBD) products are an emerging trend or just hype, new research from Acosta finds that more than a quarter of U.S. consumers are now using them.

Twenty-eight percent of consumers polled use CBD products on an as-needed (19%) or daily (9%) basis, Acosta said in its report “The CBD Effect: A Rapidly Emerging Consumer Trend,” released Tuesday. The study projects CBD product sales to consumers to hit $20 billion by 2024.

CBD in recent years has become a popular remedy for a range of everyday health issues. A naturally occurring and non-intoxicating compound in hemp plants, CBD is permitted within federal and state regulations.

“Health ailments without a ‘one-size-fits-all treatment’ are quite common, and avoiding chemicals when it comes to health and self-care is important across all age groups. CBD sales and projections show consumers are turning to CBD for help, and demand is growing rapidly,” according to Colin Stewart, senior vice president of business intelligence at Acosta, a Jacksonville, Fla.-based consumer packaged goods (CPG) sales and marketing firm.

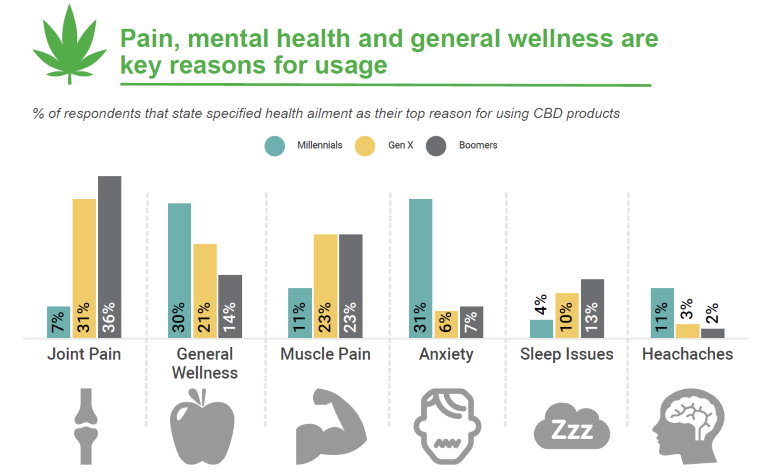

The top uses of CBD products are for joint pain, general wellness, muscle pain, anxiety, sleep issues and headaches, Acosta’s study said. Interestingly, 59% of respondents’ first-time CBD product purchases were planned, compared with 25% being an impulse buy and 7% doctor-recommended.

Consumers generally have a positive view of CBD products, despite some uncertainty, Acosta found. Fifty-five percent agreed with the statement “CBD oil is/might be a new miracle treatment” versus 35% being unsure what to think about CBD oil and 11% deeming the products as “just hype.”

By a large margin, CBD product users are Millennials (56%), men (48%) and college-educated (49% have a bachelor’s degree). Twenty-eight percent of users are women, 32% are from Generation X and 15% are Baby Boomers.

Millennials most often use CBD products to ease anxiety (31%) and for general wellness (30%), Acosta reported. Among Gen Xers and Boomers, these products are most commonly used to alleviate joint pain (31% and 36%, respectively) and muscle pain (both 23%).

Consumers who haven’t tried CBD items cite pricing, insufficient research and distrust in product claims as the top barriers to usage, the study said. Of those open to trying CBD offerings, 26% said these products are too expensive, 18% said there aren’t enough studies, 14% don’t trust claims, 13% think there’s not enough regulation and 13% said CBD items are difficult to find.

Meanwhile, consumers who said they aren’t open to trying CBD products named lack of studies (29%), distrust of product claims (29%), moral issues (18%), price (7%) and insufficient regulation (7%) as the chief reasons.

Many retailers remain uncertain about the regulatory framework regarding the sale and labeling of hemp-containing products, even as various CBD offerings continue to make their way into stores. Scientific research on CBD’s potential health benefits also is still in its early stages.

Late last year, the federal government changed its classification of cannabis with the enactment of the Farm Bill. The legislation removed hemp from the Federal Controlled Substances Act’s definition of marijuana. That meant hemp was no longer a controlled substance under federal law, even though marijuana remains a Schedule I drug.

Under current federal law, CBD and THC can’t be added to a food or marketed as a dietary supplement. The Food and Drug Administration maintains regulatory oversight of food, cosmetics, drugs and other products within its jurisdiction that have CBD, THC or the cannabis plant as an additive.

The CBD product market’s potential, however, has drawn the interest of retailers large and small, including the nation’s largest supermarket operator, The Kroger Co., as well as small chains like Dierbergs Markets and online grocers such as Thrive Market.

In June, Kroger confirmed plans to roll out CBD topical products to 945 stores in 17 states. That has since risen to more than 1,300 stores in 22 states, including the Kroger, Dillons, Fry’s, Fred Meyer, King Soopers, Mariano’s, Pick 'n Save, QFC and Smith’s banners. Last month, Kroger rolled out CBD lotions, balms, oils and creams to 88 stores in its Houston division and made the items available via its Ship.Kroger.com direct-to-customer service and Vitacost.com e-commerce unit.

Retailers can entice more consumers to try CBD products by providing samples, entry-level pricing, in-store education (including via signage, endcaps and knowledgeable staff), coupons and discounts, user testimonials and access to research, among other tactics, Acosta’s CBD Effect study said.

Stewart underscored the category’s promise. “Consumer CBD sales are expected to reach $20 billion by 2024, larger than the current annual sales of candy, gum and mints combined,” he noted.

That includes pet care. One in 10 pet owners have bought CBD products for their pets, with 52% making the purchase based on a veterinarian’s recommendation, the Acosta report found. The top pet CBD products purchased were treats/chews (48%), oil (27%), capsules (14%) and topical ointment (9%), primarily for pain (29%), anxiety (32%) and general wellness (29%).

Acosta said its research was based on a July 2019 shopper survey and internal subject matter experts and included projections from BDS Analytics, a cannabis market tracking firm. (Note: Chart graphics from Acosta’s „The CBD Effect: A Rapidly Emerging Consumer Trend” report, September 2019.)